Bitcoin's Dark Secret: When Freedom Becomes Control

From Liberation Technology to Surveillance Infrastructure: Bitcoin's Role in Shaping the Future of Financial Control

I. The Perfect Promise

It started with a promise.

A currency free from central banks. Immune to manipulation. A system built on transparency and trust, yet beholden to no one. Bitcoin was supposed to be the exit door - a way out of a corrupt, decaying financial system controlled by governments, Wall Street, and technocrats.

No bailouts. No monetary policy tinkering. No middlemen. A peer-to-peer revolution.

Just math. Just code. Just freedom.

The people's money.

It was an irresistible narrative. The timing couldn’t have been better - 2008’s financial crisis had shattered public trust in traditional finance. Bitcoin appeared as a savior, an escape hatch for those who saw the writing on the wall. An elegant whitepaper, a pseudonymous author, and a vision of a new world where money belonged to the people, not the institutions.

It was the perfect pitch: a currency free from political influence, immune to manipulation, decentralized, scarce, and permissionless. The ultimate antidote to a corrupt system. Bitcoin became more than just code. It became a cause.

But here’s the question no one dared ask:

What if this was exactly what they wanted us to believe?

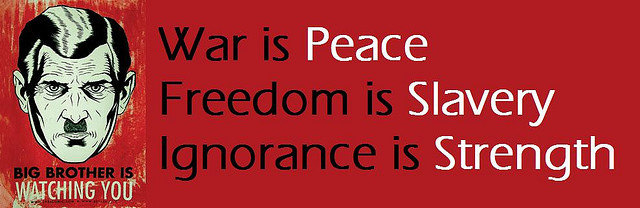

Because when you strip away the romanticism, you're left with a chilling possibility: A fully transparent ledger where every transaction is permanent. A network that demands enormous energy, dependent on centralized infrastructure. A digital economy increasingly compliant with regulatory frameworks. An ecosystem where control doesn't require ownership - only the right levers at the right time.

When you look at the structure, the gatekeepers, and the inevitable trajectory, a darker picture emerges. One where Bitcoin didn’t free the world - it trained it to accept its future chains.

We believed Bitcoin was our way out. But maybe it was the cage being built around us - brick by invisible brick. The most elegant control system is the one that feels like liberation.

II. The Legend of Satoshi Nakamoto

"Every great illusion starts with a moment you desperately want to believe in."

Bitcoin's creation story is digital folklore. A pseudonymous genius - Satoshi Nakamoto - releases a whitepaper that lays the foundation for a decentralized future. Then, after mining the genesis block and accumulating over a million bitcoins, Satoshi vanishes without a trace.

No interviews.

No slip-ups.

No mistakes.

The ultimate ghost.

But real revolutions are messy affairs with human fingerprints all over them. Bitcoin's birth was suspiciously clean. Why would the architect of a supposed revolution disappear right as their creation began to change the world? No founder disputes. No leadership battles. No messy human flaws.

A lone genius? Or an operation?

Bitcoin’s design required mastery of:

Cryptography (perfected implementation of SHA-256)

C++ programming (flawless, scalable codebase)

Game theory & economic models (understanding incentive structures)

Network security (resistance to Sybil attacks and Byzantine faults)

The probability that one person, acting alone, could produce something so technically perfect and politically potent is near zero.

And then there’s this:

In 1996, over a decade before Bitcoin’s launch, the NSA published a paper titled "How to Make a Mint: The Cryptography of Anonymous Electronic Cash."

The paper described a digital currency system eerily similar to Bitcoin - complete with public-key cryptography, decentralization, and pseudonymous transactions.

The NSA also developed SHA-256 - the cryptographic algorithm that underpins Bitcoin’s security. More than a decade before Satoshi's whitepaper, the intelligence community had already mapped the blueprint for what would become Bitcoin.

Why did Satoshi choose an algorithm created by an agency known for its surveillance capabilities?

If Bitcoin was meant to be a tool of financial freedom, why did its architecture align so well with state-level interests in financial monitoring and control?

The timing compounds the suspicion. Bitcoin emerged precisely as the 2008 financial crisis reached its climax - when banks were collapsing, governments were orchestrating massive bailouts, and public trust in financial institutions hit historic lows. The perfect conditions for an alternative system to gain traction.

This pattern, of course, follows the classic formula for global transformation:

Problem: The collapse of trust in the global financial system.

Reaction: Widespread demand for alternatives.

Solution: A “decentralized” digital currency promising freedom.

The same playbook is being played over and over and over again.

When a solution appears at the exact moment of maximum receptivity, it's rarely coincidence.

What's even more revealing isn't who created Bitcoin, but who built its infrastructure. Early Bitcoin development and adoption had surprising connections to Silicon Valley elites - particularly the "PayPal Mafia," that group of former PayPal founders who went on to reshape the tech landscape.

PayPal itself was initially conceived as a global currency outside government control. Peter Thiel, PayPal's co-founder, articulated this vision clearly:

"PayPal was meant to be the first digital currency, free from state control. We didn't succeed, but perhaps something else will."

Just a few years later, Bitcoin emerged - addressing the very problems that prevented PayPal from becoming that global currency.

Consider these connections:

Bitcoin solved the double-spending problem that plagued earlier digital currencies

It appeared right when faith in traditional finance collapsed

Its infrastructure was quickly built by the same Silicon Valley powers supposedly threatened by it

Its narrative perfectly targeted those most disillusioned with the existing system

The most sophisticated operations don't appear as control - they appear as liberation. They don't restrict choice - they channel it. They don't ban alternatives - they absorb them.

This isn't to claim Satoshi was a front for Silicon Valley or intelligence agencies. But whoever Satoshi was, their creation served as the perfect vehicle for a vision of digital money that predated Bitcoin itself - a vision that powerful interests had been pursuing for years.

The first rule of pattern recognition is this: when something seems too perfect, look deeper. And Bitcoin's origin story is almost too perfect not to be engineered.

III. The Illusion of Decentralization

"The greatest trick isn't making something appear - it's making something disappear."

Bitcoin's fundamental promise is decentralization. No central authority. No single point of failure. No controlling entity. This narrative is so powerful it's become almost religious dogma among believers.

But what if decentralization is more marketing than reality?

The hard truth emerges when we ask a simple question: Who actually controls Bitcoin? Not in theory, but in practice.

Bitcoin's consensus mechanism - proof of work - was designed to distribute power across thousands of miners worldwide. Anyone with computing power could participate in validating transactions and securing the network. The system would be democratic by design.

That's the theory. The reality looks dramatically different.

Today, Bitcoin mining exists as a highly centralized industrial operation dominated by a few key players:

Just 3-4 mining pools regularly control more than 50% of the network's hash rate

Geographic concentration in regions with cheap electricity and questionable governance

Custom ASIC hardware produced by a handful of manufacturers

Energy dependencies on national grids and policies

This concentration creates overlooked vulnerabilities. If a few major mining pools coordinated - or were pressured by state actors - they could, in theory:

Censor specific transactions by refusing to include them in blocks.

Prioritize or delay transactions based on external incentives.

Enforce regulatory blacklists (e.g., OFAC-sanctioned addresses).

Reorganize the most recent blocks to reverse or modify very recent transactions (though not deep transaction history).

It wouldn’t require a 51% attack or an outright government takeover. Subtle economic incentives, regulations, or even coercion could be enough to shape Bitcoin’s transaction flow - without users realizing it.

The centralization problem extends beyond mining. Bitcoin's code itself - supposedly the immutable foundation of the system - evolves through a process controlled by a remarkably small group of developers.

Bitcoin Core, the reference implementation that most of the network runs on, has fewer than 20 developers with commit access. This small team effectively determines Bitcoin's technical direction. While they can't force changes on the network, their decisions about what code to merge, what bugs to fix, and what features to include shape Bitcoin's evolution.

This isn't necessarily nefarious - these developers are generally respected in the community. But it creates a concentration of influence that contradicts the decentralization narrative. When changes need to be made, the community overwhelmingly follows their lead.

The Bitcoin Improvement Proposal (BIP) process, while theoretically open to anyone, funnels through these gatekeepers. Major decisions about Bitcoin's future - like block size limits that determine transaction throughput - have ultimately been decided by this small group, not through some idealized distributed consensus.

Even more concerning is the centralization of Bitcoin's supporting infrastructure:

Exchange concentration: Most Bitcoin trading occurs on a handful of major exchanges

Wallet software: A few dominant solutions control the user experience

Node distribution: Despite the potential for widespread participation, node count remains relatively low

Development funding: Key Bitcoin infrastructure projects receive funding from a small pool of wealthy individuals and companies

The Blockstream phenomenon exemplifies this problem. This single company, well-funded by traditional venture capital, employs several key Bitcoin Core developers and controls critical scaling infrastructure like the Lightning Network. Their influence on Bitcoin's technical roadmap raises obvious questions about decentralization.

None of this means Bitcoin is centrally controlled in the way traditional financial systems are. But it reveals a more nuanced and uncomfortable truth: Bitcoin's decentralization exists on a spectrum, not as an absolute. And on that spectrum, Bitcoin sits closer to centralization than its narrative suggests.

The revolution promised escape from opaque power structures. Instead, it may have simply created new ones - less visible but no less real.

IV. The Transparent Prison

Bitcoin's greatest selling point was always freedom. Freedom from inflationary fiat currencies. Freedom from intrusive banks. Freedom from governments that could freeze, seize, or inflate away wealth.

But what if that freedom was just a clever illusion?

Consider this: Bitcoin is the most transparent financial system ever created. Every transaction is traceable. Every movement of funds recorded - forever. Unlike cash, there's no way to erase the trail. We were told this transparency was a feature, not a bug. But transparent money is controlled money - all it needs is the right tools for analysis and the right excuse for enforcement.

And now those tools exist.

The Nakamoto paradox is this: a system designed to free us from financial surveillance has created the most comprehensive financial surveillance infrastructure in history. Your entire economic life, immortalized on an immutable ledger, visible to anyone who cares to look. Privacy through obscurity was never a sustainable strategy.

When you look beyond the rhetoric of financial liberation, what Bitcoin actually delivers is a strange inversion: it removes the privacy protections of cash while adding none of cash's benefits for daily, private transactions.

The Surveillance Potential Hiding in Plain Sight:

Every wallet you've ever used, linked in a permanent chain

Transaction patterns that reveal your behaviors, preferences, and connections

Metadata that can identify you despite "pseudonymity"

AI analytics capable of finding patterns humans would miss

The choke points aren't theoretical - they're already operational. Bitcoin may be decentralized, but to use it in the real world, you need exchanges and custodians. These "on-ramps" and "off-ramps" have become perfect control points - easily regulated, surveilled, and, if necessary, shut down.

KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations now require detailed personal information for anyone using these platforms. You can own your private keys - but what good are they if you can't convert them into usable currency without exposing your identity?

The network may be decentralized, but access is not.

Here's an uncomfortable thought experiment: What if Bitcoin's transparency wasn't an oversight but its purpose? What if the goal was never to create anonymous money, but rather to condition people to accept a financial system where privacy is impossible?

Enter Palantir.

This is where Peter Thiel's shadow looms large over Bitcoin's infrastructure. Thiel's Palantir - a company, run by Alex Karp, that builds surveillance tools for governments worldwide - specializes in aggregating massive datasets to identify patterns. If any company could make sense of blockchain transaction data and link it to real identities, it would be Palantir.

But the connections run deeper. Bitcoin's security relies on SHA-256, a cryptographic hash function developed by none other than the NSA. Of all available hash functions, Satoshi chose one created by the very agency with the most advanced cryptanalytic capabilities in the world.

The implications are troubling. The NSA has a documented history of influencing cryptographic standards, sometimes inserting undetectable backdoors. Through programs like PRISM (revealed by Edward Snowden), they gained unprecedented access to global data streams. Combine this surveillance capability with Bitcoin's public ledger, and the potential for total financial monitoring becomes clear:

Every transaction permanently recorded on the blockchain

Advanced network analysis capable of de-anonymizing pseudonymous wallets

Metadata collection that could map entire networks of financial activity

Potential cryptographic vulnerabilities known only to the creators

The Silicon Valley-Intelligence Community nexus completes the picture. Thiel, an early Bitcoin proponent, co-founded Palantir with CIA funding. The PayPal Mafia (including Thiel and Elon Musk) pioneered online payments - the perfect training ground for digital financial systems. Elon Musk has also claimed that the goal of X (former Twitter) is to become an “everything app” - like the Chinese WeChat where users use the app for everything ranging from social media and interactions with authorities to payments. Meanwhile, the NSA has historically collaborated with tech companies to deploy surveillance technologies under the guise of consumer convenience.

And now we watch as Central Bank Digital Currencies (CBDCs) emerge on the horizon. They promise efficiency, speed, and convenience - but they come with total surveillance baked in. Governments can program them, restricting how and where money is spent.

Bitcoin enthusiasts believed they were opting out of this system. But what if Bitcoin was always a stepping stone - a tool to normalize digital currencies in the public mind? A Trojan horse that made people comfortable with digital money, paving the way for CBDCs that would remove the illusion of freedom altogether.

When the time comes for governments to tighten control, Bitcoin's fully transparent ledger becomes a gift. With AI-powered surveillance tools, every transaction can be mapped, every network of users identified.

No more offshore accounts. No more hiding wealth.

The final irony may be this: Bitcoin didn't destroy financial surveillance - it perfected it. While the community was focused on resisting central banks, they built the infrastructure for a surveillance system beyond anything those banks could have implemented on their own.

The system doesn't need to own Bitcoin to control it. It just needs to watch it.

V. The Institutional Absorption

Bitcoin was pitched as the antithesis of Wall Street. A decentralized revolution that would bypass traditional finance, rendering the old guard obsolete.

But a curious thing happened on the way to this financial utopia: Wall Street didn't fight Bitcoin - it embraced it.

2024 marked a turning point. The BlackRock iShares Bitcoin ETF received approval, hailed as a major step toward mainstream adoption. Fidelity, Goldman Sachs, JPMorgan - one by one, the titans of traditional finance incorporated Bitcoin into their offerings. The narrative shifted from disruption to "digital gold" almost overnight.

Why would the very institutions Bitcoin was meant to disrupt so eagerly adopt it?

To understand this apparent contradiction, we need to recognize a fundamental truth about power: it doesn't resist what it can absorb. Throughout history, truly threatening technologies and movements aren't fought - they're co-opted.

When Larry Fink, CEO of BlackRock, started referring to Bitcoin as "digital gold," it wasn't just a catchy phrase - it was a strategic reframing. Digital gold is inert. It sits. It stores value. It doesn't threaten the financial system - it supports it.

Gold never threatened banking. It became their foundation.

The institutional strategy unfolded in three phases:

First came ridicule. Jamie Dimon called Bitcoin a "fraud." Warren Buffett labeled it "rat poison squared." This phase created the narrative of Bitcoin versus the establishment - the rebel currency fighting the system.

Then came cautious exploration. Banks built blockchain teams. Investment firms studied cryptocurrency markets. They absorbed the technology while professing skepticism about the asset.

Finally, they emerged as Bitcoin's champions - but on their terms. Not as peer-to-peer cash, but as a regulated, institutionalized asset class. The revolutionary became the regulated.

This institutional embrace created the perfect controlled opposition. Bitcoin appears to be free, but every access point leads back to the same power centers:

"If you want to neutralize a potential threat, don't fight it openly - guide it to where you want it to go."

The transformation is almost complete. Major Bitcoin holdings now rest with the same institutions that Bitcoin was meant to circumvent. The exchanges where most people buy and sell are fully regulated, KYC-compliant businesses. The infrastructure runs on corporate servers.

For Wall Street, Bitcoin solved a problem they didn't know they had: how to bring unregulated wealth into the regulated system. How to map the financial activities of those who had rejected traditional banking. How to create a bridge between the rebellious fringes and the controlled center.

Think about market manipulation. Bitcoin's price surges have created enormous wealth - but for whom? Institutional players with deep pockets can accumulate quietly, pump the price with bullish narratives, then exit at the peak, leaving retail investors holding the bag. A wealth transfer on a global scale, moving funds from everyday adopters into the hands of institutions.

Institutional control extends beyond direct market participation into Bitcoin’s very trading infrastructure.

Tether (USDT), the dominant stablecoin, powers most Bitcoin transactions. Supposedly backed 1:1 by U.S. dollars, it has printed billions with minimal transparency. This creates the perfect control mechanism - a centralized entity issuing unbacked “digital dollars” to inflate Bitcoin’s liquidity.

If Tether collapses, Bitcoin’s market structure could implode overnight. The so-called decentralized currency is propped up by a private money printer with no real oversight.

The implications are clear: Bitcoin’s price isn’t driven by organic market forces - it’s manipulated through Tether’s unchecked issuance. The same institutions Bitcoin was meant to circumvent now dictate its price through these financial levers.

This is the ultimate control layer: a kill switch that can crash the entire ecosystem when needed. And who holds this switch? The same financial and regulatory powers Bitcoin was designed to escape.

What looked like mass adoption turns out to be a controlled rollout:

Wall Street legitimizes Bitcoin for institutional investors

Regulators ensure all legal access points are surveilled

Silicon Valley's AI tools map every transaction and identity

By the time the masses realize it wasn't the revolution they hoped for, it's too late. Bitcoin never disrupted the system. It completed it.

Lenin supposedly said: "The most effective way to control the opposition is to lead it ourselves." If Bitcoin was seeded by the very institutions it claimed to bypass, we're once again witnessing one of the most sophisticated Trojan Horses in financial history.

The question isn't whether Bitcoin can be used for control. It's whether it was designed for it all along - a global financial panopticon hiding behind revolutionary rhetoric.

VI. The Behavioral Programming Blueprint

The most effective control doesn't feel like control at all - it feels like choice.

Bitcoin's adoption didn't just normalize digital money; it normalized programmable money - currency that can be tracked, influenced, and subtly manipulated. The public embraced digital wallets, blockchain transactions, and smart contracts, thinking they were opting into freedom.

But what if every transaction, every holding, and every choice you make with your "decentralized" money feeds a behavioral algorithm designed to guide you?

This isn't science fiction. It's behavioral economics applied to digital currency.

Imagine combining the principles of behavioral economics with full financial transparency and AI-powered analysis. The result? A system where you think you're making free choices, but every option has been optimized to nudge you toward specific behaviors.

Bitcoin has created the perfect test environment. By watching how millions of people react to Bitcoin's volatility, transaction costs, and trading patterns, institutional players have mapped behavioral triggers: How much friction leads to panic selling? What incentives encourage HODLing versus spending? How do social narratives influence buying?

This data feeds into the next-gen financial architecture - one that's fully programmable and responsive in real time.

Here's where the true sophistication emerges. Frictionless compliance doesn't require force - just the right incentives:

Dynamic transaction fees that make "preferred" behaviors cheaper and "problematic" ones prohibitively expensive.

Carbon-scored spending that limits certain activities through financial penalties disguised as "offsets."

Social alignment scoring that subtly rewards conformity and penalizes divergence through transaction speeds and costs.

You'll choose the "correct" behavior because the alternative becomes economically inconvenient. No one forces you - you "freely choose" the path of least resistance.

This is why CBDCs and Bitcoin can coexist - and why that coexistence might be the trap. Bitcoin becomes the gateway drug: the "freedom coin" used to onboard the masses into digital finance. As people move wealth into Bitcoin (trusting its decentralization), institutions gradually tighten regulations at every access point.

Eventually, CBDCs emerge as the stable, "safe" alternative, backed by the same institutions now controlling Bitcoin's liquidity and compliance layers.

The perfect bait-and-switch.

What makes this strategy brilliant is that it doesn't require conspiracy - only aligned incentives. When financial freedom is weaponized, compliance becomes self-imposed:

You won't need a government mandate to limit your carbon footprint; you'll limit it yourself to avoid higher fees.

You won't need explicit censorship; you'll self-censor because supporting unapproved causes affects your financial privileges.

You won't need explicit social credit systems; your economic reputation - driven by institutional liquidity providers who control Bitcoin on- and off-ramps - becomes your score.

In this light, Bitcoin serves as the perfect psychological conditioning tool. It trains users to:

Accept digital-only wealth

Surrender financial privacy

Trust blockchain-based systems

Normalize KYC/AML compliance

Value liquidity over sovereignty

Each of these mental shifts prepares the ground for CBDCs and fully controlled digital finance.

When Thiel said PayPal was meant to be the first digital currency but failed, perhaps Bitcoin succeeded where PayPal couldn't - not by destroying the system, but by creating the psychological conditions for its next evolution.

The final irony? Those most passionate about Bitcoin's liberating potential may be the most thoroughly conditioned to accept its replacement. And for those who do see through the illusion, the system has another layer of control waiting.

VII. Escape Routes

For those who recognize the behavioral conditioning and surveillance potential of Bitcoin, the natural response is to seek alternatives:

Monero for privacy. Decentralized exchanges for censorship resistance. Self-custodied wallets beyond institutional control.

But even this reaction appears to have been anticipated. The architects of digital control don't just plan for mass adoption - they plan for resistance.

The closing of alternative paths follows a predictable pattern - not through prohibition, but through something more subtle: delegitimization, liquidity starvation, and narrative warfare.

First comes the framing. Privacy coins aren't labeled "secure" or "protective" - they're branded as "tools for criminals." Media headlines associate them with dark markets, ransomware, and terrorism. The average person begins to self-censor their interest in privacy technologies out of fear of suspicion.

Then comes regulatory pressure. Exchanges delist privacy coins, citing "compliance concerns." Banks refuse to process transactions for businesses that touch them. The infrastructure available to Bitcoin slowly withdraws from privacy-focused alternatives.

Finally, liquidity dries up. Without major exchange support, trading volumes decline. Without liquidity, merchant adoption becomes impractical. Without practical use cases, the value proposition weakens. The alternative becomes an isolated island in the financial system - technically functional but practically useless.

This isn't speculation. We've watched it happen with Monero, Zcash, and other privacy-focused cryptocurrencies. They exist, but on the margins - contained, monitored, and effectively neutralized as serious threats to surveillance capitalism.

Even the technology itself faces compromise. Blockchain analysis firms, often funded by the same governments and corporations supposedly threatened by cryptocurrency privacy, develop increasingly sophisticated tools to pierce anonymity guarantees.

The greatest irony? These analysis tools are trained on the very transaction data that privacy advocates generate while trying to escape surveillance. Every attempt to evade monitoring provides more data to refine the monitoring systems.

This is the genius of the control system being built: it doesn't prohibit alternatives - it studies them, contains them, and ultimately absorbs whatever innovations they create.

Consider what happened with Tornado Cash, a mixing service designed to provide privacy on Ethereum. When it gained meaningful adoption, the response wasn't just to sanction it - but to criminalize interaction with its code. The message was clear: privacy technologies will be tolerated only until they become effective.

What about truly decentralized systems? Here, control takes a different form. True decentralization often comes with technical complexity that limits mass adoption. By designing user experiences that subtly guide users toward controlled, surveilled options, the system ensures most people choose convenience over privacy.

Think about your own cryptocurrency experience:

Have you kept all your funds in non-custodial wallets, or do some rest on exchanges?

Have you used privacy technologies consistently, or only occasionally?

Could you function financially if completely cut off from the banking system?

For most, the honest answer reveals the trap: we've accepted partial surveillance for convenience. We've chosen regulated services because they're easier. We've compromised because the alternative is too cumbersome for daily use.

The true prison isn't built with bans and prohibitions. It's built with incentives that make freedom impractical and surveillance convenient.

The libertarian dream of sovereign individuals transacting freely has been contained not through force, but through the subtle architecture of choice - where the easiest paths all lead back to the same controlled systems.

And on the horizon looms the ultimate false choice: CBDCs marketed as "just like Bitcoin, but better." The perfect bait-and-switch, made possible by years of normalized digital currency use.

VIII. The Patterns Versus Coincidence Debate

Critics will say this analysis attributes too much coordination to disparate actors - that no cabal could orchestrate something so complex across decades. They'll point to Bitcoin's public development history, its messy governance battles, and the apparent contradictions in its evolution as evidence against a master plan.

A reasonable objection. Complex systems rarely follow perfect scripts.

But there's a crucial distinction between claiming "a singular conspiracy with perfect execution" and recognizing "aligned interests leveraging emergent patterns." Power doesn't require perfect coordination - only aligned incentives and opportunistic adaptation.

Consider how evolution works: no central planner, yet complex systems emerge through natural selection. Institutional power operates similarly. When surveillance capabilities emerge from Bitcoin's transparent ledger, intelligence agencies don't need to have planned it - they simply need to recognize and exploit the opportunity. When Wall Street sees a way to absorb a potential threat, explicit collusion isn't necessary - just parallel action driven by common interests.

Yes, Bitcoin has enabled some forms of financial sovereignty. Yes, its development history includes genuine debates and community input. These realities don't contradict the larger pattern - they're consistent with how sophisticated systems of control operate in the information age. They provide just enough authentic freedom to make the illusion compelling.

The most effective cage isn't one with perfect bars - it's one where the occupants debate whether they're in a cage at all.

IX. Breaking the Cycle

If Bitcoin's infrastructure, adoption narrative, and institutional embrace were shaped - even subtly - by the same actors who dominate surveillance tech, finance, and political influence, then a haunting question emerges:

Was Bitcoin ever truly decentralized, or has it always been a controlled on-ramp into a digital financial panopticon?

The evidence points to a discomforting conclusion: Bitcoin may not be the revolution we thought, but rather the bridge to a new form of financial control - one that feels like freedom while delivering unprecedented surveillance capabilities.

But here's the thing: awareness itself is power. The moment we recognize how systems can be co-opted, we unlock the ability to resist them. Bitcoin may not be the flawless solution many hoped for, but it has ignited a global conversation about sovereignty, freedom, and decentralization - and that spark cannot be extinguished.

The path forward requires more than just technical solutions. It demands a fundamental rethinking of how we approach digital freedom in an age of surveillance capitalism.

Reclaiming True Financial Sovereignty

Liberation begins with clarity. True financial sovereignty won't come from a single technology or system - it will emerge from conscious choices and community-based approaches:

Recognize the Limitations of Technical Solutions Alone

Technology without consciousness becomes another form of control. Any system - no matter how brilliantly designed - can be co-opted if users don't understand its true nature. Technical literacy is our first line of defense against manipulation.

Build Resilient Local Networks

The most powerful resistance is the one closest to home. Local economies, community exchanges, and direct relationships create resilience that global surveillance finds harder to penetrate. The revolution isn't just digital - it's relational.

Question the Narratives

When something is universally praised by the powers it supposedly threatens, be suspicious. Wall Street's embrace of Bitcoin isn't validation - it's a warning sign. Train yourself to spot the difference between authentic movements and controlled opposition.

Value Privacy as a Fundamental Right

In a world of total transparency, privacy becomes revolutionary. Support technologies and practices that genuinely protect privacy - not just those that claim to. And remember: convenience is the currency with which we often pay for our own surveillance.

Diversify Beyond Digital

True sovereignty doesn't exist in any single realm. Digital-only wealth creates digital-only vulnerabilities. Resilience comes from diversity - of assets, of communities, of approaches to exchange and value.

The most important insight may be this: The revolution doesn't end with Bitcoin. It begins when we refuse to let our freedom be someone else's business model. It grows when we recognize that true freedom isn't found in code alone, but in conscious communities making deliberate choices about how they exchange value.

Bitcoin revealed something profound - not just about technology, but about human longing for sovereignty in an increasingly controlled world. That longing is real and legitimate. But the path to its fulfillment may not be what we initially imagined.

Perhaps Bitcoin's greatest contribution wasn't as the solution itself, but as the catalyst that forced us to ask deeper questions about money, power, and freedom in the digital age. Questions that, once asked, cannot be unasked. But perhaps I am just crazy here.

The final ledger is still being written. And despite all attempts at control, the pen remains - at least partly - in our hands.

Share this. Expose the illusion. Build the future.

/ Erik

Continue reading:

Checkmate: The Triumph of Technocracy (Part 1)

How Trump, Elon & The Tech-Elite are Paving the Way for a Brave New World and what it means for all of us.

Triumph of Technocracy Part 2: The Ultimate Deception

How the Pandemic Sorted, Profiled, and Set Up the Resistance for the Perfect Trap

"The Matrix" Is Not What You Think - Here’s Why It Matters

How Your Perception of Reality Has Been Engineered - And What You Can Do About It

The Last Red Pill: Becoming Truly Unfuckwithable

The Inner Power No Algorithm Can Hack, No Government or System Can Control, and the One Truth That Frees You From It All

The 50-Year Heist: How the System Stole My Father's Freedom (And Is Coming For Yours Next)

Your Financial Struggles Aren't Personal Failures - They're Symptoms of the Greatest Wealth Transfer in History

Hi Erik, I agree with you that Bitcoin and cryptocurrency in general have been the test case for upcoming programmable CBDCs, which will result in the greatest loss of freedom in human history. However, the specific mechanism that the NSA/CIA use to control the crypto space is via the flimsy Tether scam, which has more trading volume than the top ten coins *combined*. Tether is meant to be 1:1 with USD, but the evidence shows that Tether is a giant ponzi scheme and the vast majority of Tether are simply printed out of thin air and shoved into the crypto space, massively inflating it. Our elites can crash the entire crypto market in a single second by taking out Tether, and/or cutting off the fiat on/offramps like via CIA/NSA controlled scam Coinbase. See here for more: https://neofeudalreview.substack.com/p/misconceptions-regarding-viewing

And here on the upcoming digital panopticon: https://neofeudalreview.substack.com/p/on-the-digital-panopticon-mark-of

I once invested in Bitcoin, not much. Then I started thinking about it and researching it, and figured out the alleged freedom was still controlled by onramps and offramps. I could hold it as long as I wanted but in order to cash in I still had to use the financial institutions I was led to believe I had freedom from. Bitcoiners are a cult, and Bitcoin is their god.