The 50-Year Heist: How the System Stole My Father's Freedom (And Is Coming For Yours Next)

Your Financial Struggles Aren't Personal Failures - They're Symptoms of the Greatest Wealth Transfer in History

There's a hidden pattern in our economy that most people never see - but all of us experience the effects of. I've followed it for years, predicting its consequences while financial experts scratch their heads in confusion and politicians talk about everything else. This pattern explains why, despite all the "economic growth" you hear about, life keeps getting harder for most people.

I didn’t only come to understand this pattern through books or theories.

I got to experience it through my father’s life - and death.

A Life of Labor, A Moment Too Late

My father started working when he was 15. For nearly five decades, he built things with his hands - boats he would quietly point out to us when we passed them. "I helped make that one," he'd say with a flicker of pride, the closest he ever came to boasting.

He was the quintessential skilled worker - a craftsman who could shape metal into almost anything, a union leader who stood up for others even when it cost him advancement. He never held back what he thought, speaking truth to power even when it had consequences. People constantly came to him for support, and he gave freely of himself - probably to his own detriment. But that was who he was. His authenticity made him both loved and overlooked; he didn't play the corporate games that might have advanced his career.

We had that kind of father-son bond that doesn't need many words - a silent understanding, a steady presence. What always amazed me was his unwavering support when I made choices others questioned. When everyone had opinions about my life or my impulsive decisions, my father would simply be there, ready to help with whatever idea, project, or problem I had created.

In 2021, I took my family to Mexico to pursue a vision that had been forming for years. We were going to create the first of what will become a global network of net positive villages - places that integrated nature, innovation, and regenerative systems - a whole new net positive approach to living.

When we said our goodbyes to my family at the train station on our way to the airport, it was a simple, heartfelt moment - the kind that seems ordinary until later, when it dawns on you just what this moment was.

My father had been fantasizing about early retirement for years, just waiting for the right moment. This was definitely going to be his final year of work. He talked about opening a small metal workshop where he could finally build and create freely - the thing he had always loved most.

We were planning to return to Sweden for the summer, and I was excited about the possibility of my parents joining us when we went back to Mexico. I especially wanted to show my father what we were building, to have him be a part of it and meet the people who were changing the world.

I tried to convince him during one of our calls, and while he remained characteristically stoic, I could sense the idea excited him too.

A few days later i got a call from my sister and what she told me broke my heart into a million pieces.

My father had died from a sudden massive heart attack.

He was 64 years old.

My mother, his partner basically since they were 16, found him on the floor of their home. No warning. No goodbye. No retirement. No workshop. No future.

The person who was my anchor in life - just gone. There was so much left unsaid, so much left to do together. My children would never again feel his steady presence or learn from his quiet wisdom.

So many timelines, adventures, and dreams - erased in a moment.

"The problem is, you think you have time." That quote haunts me now.

My father worked himself to exhaustion in an uphill battle that began when he was 15. He spent a lifetime putting everyone else first, rarely treating himself to anything. He worked and overworked right up until the moment he decided he might finally claim some freedom for himself - and then his body gave out.

But why was it an uphill battle? Why, after nearly 50 years of hard work, was freedom still just out of reach? Why was he still struggling financially despite a lifetime of labor?

What amazes me most in retrospect is how my father endured this struggle in silence. We rarely, if at all, saw his burden. We lived a happy life - not extravagant, but never feeling poor. It was only when I was older that I realized he must have been going through things he never showed us. He wanted to protect us from feeling the weight of the system grinding him down. This realization, even before he passed, motivated me to do whatever it took to unchain myself from this system and create something better.

I could write an entire article about what this loss revealed to me personally, but that's for another time.

My father's death wasn't just a personal tragedy - it was the expression of a pattern that has been grinding down millions of lives, a pattern that's only accelerating with each passing year.

What i could see in my father's experience is a symptom facing families everywhere. The cause is a massive one-way flow of wealth that's been draining security and stability from ordinary lives with mathematical precision.

The Wealth Transfer Machine

To understand what happened to my father - and what's happening to millions of families right now - we need to uncover the invisible machine driving our economy.

Picture society divided into four groups: the working class, the middle class, the government, and the wealthy elite.

The working class includes those who rely on wages to survive, often performing manual, service, or low-salaried jobs.

The middle class is a subset of the working class but typically has more financial stability, education, or white-collar jobs. While all middle-class people are workers, not all workers are middle class.

The government consists of bureaucrats, politicians, and public officials who may come from any class but hold institutional power.

The wealthy elite are those who own rather than work, accumulating wealth through investments, businesses, or inherited assets. They often influence government and economic systems to maintain their dominance.

For a brief period after World War II, wealth was more evenly distributed among these groups. Even working-class families could afford homes, save for retirement, and build financial security. But over time, wealth began flowing overwhelmingly in one direction - upward - and that has only accelerated ever since.

This flow isn't some random occurrence. It's built into the very structure of our economy.

Here's how it works: All the physical wealth we have - homes, factories, farmland, infrastructure - exists no matter who owns it. These things produce everything we need and want. The critical question is: who owns them?

When my father started working at 15, wealth ownership was distributed broadly enough that even people with blue-collar jobs could accumulate assets. By the time he died, wealth had concentrated dramatically in fewer and fewer hands, creating a one-way flow of money:

The working class pays rent instead of building equity in homes.

The middle class pays increasing costs for education, healthcare, and housing.

The government pays interest on a growing national debt.

All these payments flow upward to those who own the underlying assets.

Every time my father paid rent instead of owning a home, that money transferred upward. Every time prices rose faster than his wages, the difference flowed upward. Every time his taxes went to pay interest on government debt rather than services, that money flowed upward.

This transfer happens in countless daily transactions so routine we barely notice them:

When a corporation raises prices but doesn't raise wages, the difference becomes profit that flows to shareholders, not workers. The items on the shelf didn't change - only who gets the value did.

When you pay $1,500 in monthly rent, that money doesn't vanish - it flows to whoever owns the building. Over 30 years, you'll pay $540,000 and own nothing, while the property owner gains both your payments and the appreciating asset.

My father's generation was the last that could reasonably expect to own a home on a single blue-collar income. By the time he reached middle age, housing prices had accelerated well beyond wage growth.

As this process accelerates, working families are squeezed harder. The middle class will gradually lose its wealth and security. The government becomes increasingly indebted. And the wealthy accumulate more assets, creating even larger future transfer payments.

Debt and personal loans become another extraction mechanism.

Across society, these debts compound the wealth transfer, with interest payments flowing upward while principal balances barely shrink. In fact, debt is the very foundation of our entire economic system - but I will explore that more deeply in another article.

Consider these numbers: since 1975, productivity has grown 62%, while hourly compensation has risen just 17%. Where did the rest go? Straight up the ladder.

This isn't conspiracy - it's math. When wealth concentrates, those without assets have to pay more to access them. And as concentration increases, so do those payments. The result is a world where people work longer and harder for less actual security, always feeling like they're falling behind despite their best efforts.

What makes this pattern so destructive is that it accelerates over time. The more wealth concentrates, the faster it can concentrate further, pushing the working class and middle class even further down.

This acceleration isn't theoretical. Just take the the pandemic as a clear example. If we disregard all the other fuckery that went on during that period and just focus on what we can clearly see, in a time where the “economy shut down” and the world at large were taking a big economic hit:

573 new billionaires were created during this period.

Corporations in energy, food, and pharmaceutical sectors recorded their highest profits ever during this time.

While the wealthy thrived, 263 million people were pushed into poverty at a rate of one million every 33 hours.

During the same period billionaires saw a wealth increase of $1 billion every two days.

Moderna and Pfizer made $1,000 profit every second by forcing the global population into taking an experimental injection we’re still working to understand the consequences of.

People talk about “the 1%" - but i don’t think people realize that 1% of the global population is somewhere around 81 million people.

The top 10 - yes, you read that correctly - the 10 richest people in the world now have more wealth than 3.1 billion people combined (the bottom 40% of humanity).

That is far less than 1% - so it’s not “the 1%” - it’s “the 0.00000012%”

We are obviously not working within a stable system - it's a spiral with predictable economic and social consequences.

This was the invisible machinery grinding down my father's life and so many others - and it's only going to get worse.

Three Critical Effects

Once this wealth transfer system takes hold, it creates a cascade of effects that reshape our entire society. These aren't random economic phenomena - they're the direct, inevitable consequences of concentrated wealth.

Wages Collapse

The first effect is the collapse of wages. When wealth concentrates, something counterintuitive happens: we get a shortage of customers alongside a surplus of desperate workers.

Think about it - in a more wealth-equal society, most people spend most of what they earn. But when wealth concentrates in fewer hands, the rich can't possibly spend all their money - so they invest it and accumulate even more. Meanwhile, everyone else has less to spend.

The result? A massive pool of people competing for jobs from a shrinking number of employers who face decreasing customer demand.

My father saw this firsthand in his later years as a production manager - young workers willing to accept lower wages, experienced colleagues being laid off, and constant pressure to cut costs while executives saw their paychecks soar. This wasn't because his company's owners were especially cruel. It was the mathematical result of a system where wealth had concentrated to the point where workers had very little bargaining power.

I remember him coming home frustrated after being forced to implement decisions that went against his values - seeing people he knew deserved their jobs being layed off, watching newcomers replace colleagues with decades of experience. The toll was visible on his face. He wasn't just tired from work; he was exhausted by the moral compromises the system demanded and he missed just being one of the workers.

Asset Prices Skyrocket

The second cascading effect is skyrocketing asset prices. The wealthy accumulate far more money than they can possibly spend, so they pour it into buying more assets - housing, land, stocks, businesses. This drives prices beyond what ordinary people can afford based on their income.

My parents considered buying a home when I was young. I remember their hesitation, and my own childish reluctance to move. What seemed like a small decision at the time closed an economic door that might never open again. As property values accelerated beyond wage growth, the possibility of homeownership slipped further away - not just for my parents but for millions of families.

The same house that would have cost him perhaps 2-3 years of income in the 1970s would cost 8-10 years of income by the time he died. Not because the house improved, but because asset inflation systematically outpaces wage growth in a wealth-concentrating economy.

Geographic Destruction

The third effect is geographic destruction. As wealth concentrates, it also physically concentrates in specific locations.

Areas without wealthy residents deteriorate while areas with wealthy residents become unaffordable for everyone else. The wealthy create enclaves where they thrive, while everyone else is pushed to the edges.

You can see this pattern clearly in places like Brazil, India, South Africa, France and of course the United States.

Wealthy enclaves like Manhattan, Beverly Hills, and Silicon Valley thrive with high-end real estate, while surrounding areas face homelessness, high crime rates, and economic decline.

This isn't just a big city versus small city phenomenon. Small wealthy towns can become incredibly expensive, while larger cities without wealthy residents deteriorate. People are forced to leave places their families have lived for generations and move to where the money is, creating overcrowding, unaffordable housing, and hollowed-out communities elsewhere.

My father remained in Sweden while I considered moving to Mexico. This wasn't just a personal choice - it reflects a world where geographic mobility increasingly becomes a necessity rather than an option. The places where previous generations could build stable lives become either prohibitively expensive or economically depleted. (Or increasingly fascistic, but that’s a different topic, though not unrelated.)

This will not get better by itself, it will only get worse. A lot worse. Each year, the wealthy capture more assets, which generates more income, allowing them to buy even more assets the next year. Meanwhile, everyone else has less to spend, can save less, and falls further behind.

Why We Don't Hear About This

If this wealth transfer is so obvious, why isn't everyone talking about it? Why isn’t it a constant topic on financial news? Why don’t politicians address it directly? Seems pretty obvious that this is a major fucking issue we need to address rather quickly, right?

The silence isn't an accident - it's built into the system.

The Education Trap

Let’s start with education. Financial experts spend years learning about economic models that deliberately ignore wealth distribution. Yes, you read that right - these models don’t even factor in inequality.

It's like studying the ocean without mentioning water.

These models obsess over averages - GDP, unemployment rates, inflation - while completely ignoring who actually owns what. But averages are misleading as hell. If Jeff Bezos walks into a homeless shelter, everyone there becomes a "millionaire on average" while nothing actually changes for the homeless people.

I didn't need a fancy education in economics to see this pattern. In fact, not being indoctrinated probably made it easier to spot what's actually happening in front of our faces.

The Money Trap

Once you understand this wealth transfer system, you face a tough choice. You can either use that knowledge to try to get rich, or try to change the system and deal with constant pushback.

Understand how wealth concentration affects markets? Great! Hedge funds will probably be happy to pay you millions if you help them profit from it. Want to explain to the public how badly they're getting fucked? Good luck getting a platform or being taken seriously.

The system rewards those who play along and punishes those who challenge it. That's why the people who truly understand this system are either profiting from it quietly or speaking out from the fringes where no one is really listening.

The Class Bubble

The powerful voices in finance and politics are all benefiting from the current system. They own property in hot markets, have large investment portfolios, and move in circles where wealth extraction works in their favor.

This doesn't necessarily make all of them bad people - it just means they live in a completely different reality from most of us. When they look at the economy, they see a different picture because the system is working for them and everyone they know.

The Political Theater

All major political parties avoid touching the root cause of inequality, and will do their best to keep us distracted with other meaningless nonsense issues while dancing around the one thing that would actually make a difference.

One side preaches "free markets" while doing everything they can to protect the wealth of the few. The other focuses on representation and identity while accepting the same fundamental economic structure. Neither challenges the one-way flow of wealth.

They create the illusion of fierce debate while the wealth transfer mechanism runs uninterrupted regardless of who's in power. The boundaries of "serious" economic discussion are carefully maintained to exclude what's actually happening.

Here’s something interesting for you:

The three richest people in the US hold more wealth than the bottom half of the country - 170 million Americans - in what is considered the world's strongest economy. Even more interestingly but perhaps not surprisingly if you pay attention, those same people were standing behind Donald Trump at his inauguration - Elon Musk, Jeff Bezos and Mark Zuckerberg.

The result? Most people sense something is wrong but can’t put their finger on it. They know they're working harder for less security, but the root cause is invisible in mainstream conversations.

This silence is strategic. As long as we don’t see the pattern, we can’t organize to change it. We're left fighting over scraps while the wealth transfer accelerates - the system works best when the people it’s exploiting don’t even understand how it’s happening.

My father understood these forces to some degree. As a union leader, he saw firsthand how the system was structured to extract value from workers' labor. He fought against it in ways available to him. But this machinery is too vast, too deeply embedded to be overcome through individual resistance alone.

Historical Context: We've Solved This Before

Here's the thing most people don't realize: we've faced this exact problem before and solved it. To the extent it can be solved without disruption.

The early 20th century looked very similar to today. Wealth had concentrated to extreme levels. The richest 1% controlled nearly half of all wealth. The average worker endured brutal conditions with little financial security. Owning a home, retiring comfortably, or even just making ends meet was out of reach for most people.

Sound familiar?

Then things changed. Between 1930 and 1980, the wealth gap shrank dramatically. The richest 1% saw their share of total wealth cut in half, and for the first time in history, a strong middle class emerged - owning a meaningful share of society’s assets.

This didn’t happen by chance. It wasn’t some natural economic cycle. It was the result of deliberate policy decisions made in response to the Great Depression and World War II:

✅ Progressive taxation on wealth

✅ Strong labor protections that gave workers bargaining power

✅ Financial regulations that prevented excessive speculation

✅ Massive public investments in infrastructure, education, and housing

✅ Breaking up monopolies to limit corporate power

These measures didn't destroy capitalism or prevent innovation. In fact, they created the most broadly prosperous era in modern history. The period from 1945 to the late 1970s saw the fastest growth in middle-class wealth ever recorded (with one fascinating exception i won’t go into here). Productivity gains actually translated to higher wages. One income was enough to support a family, own a home, and retire with dignity.

My father started working at the tail end of this more balanced period. He entered a world where a welder with no university education could reasonably expect to achieve financial security. The dream of retiring with dignity and pursuing his own creative interests wasn't far-fetched - it was the norm.

But in the late 1970s and early 1980s, the wealth transfer machine was switched back on and everything shifted.

A new economic ideology took hold, promising that free markets - without restraint - would create prosperity for all. What actually happened was a full-speed reversal:

🔻 Tax burdens shifted from the wealthy to workers

🔻 Financial regulations were dismantled

🔻 Labor protections were weakened

🔻 Public assets were privatized

🔻 Corporate consolidation accelerated

The result? Wealth inequality has now returned to levels not seen since the 1920s. The share of wealth owned by the top 1% has more than doubled since 1980, while the bottom 50% of Americans own just 2.5% of the country's wealth. And the richest 10 people own more than 40% of the global population, the 0.00000012% we talked about earlier.

Sweden: From Model to Mirage

Image from a part of my home town Göteborg called Lindholmen.

What makes my father's story particularly revealing is that it happened in Sweden - a country once internationally celebrated as the model of economic equality.

Sweden's prosperity and equality didn't happen by accident. It was the direct result of arbetarrörelsen - the workers' movement - which fought for decades to ensure that ordinary people received their fair share of the nation's wealth. Through strong unions, collective bargaining, and political organizing, they built a system where wealth flowed more evenly, creating one of the most prosperous and equal societies in modern human history. My father was part of this tradition as a union leader, standing in solidarity with fellow workers against the forces trying to extract more for less.

But Sweden has undergone a profound transformation in recent decades. (In some sense, starting with the “unsolved” assassination of Swedish prime minister Olof Palme - yet another fascinating story for another time).

The systematic dismantling of the wealth tax and inheritance tax created a paradise for the ultra-wealthy. Property prices skyrocketed, dramatically increasing the wealth of those who already owned assets while pushing ownership beyond reach for younger generations. Meanwhile, capital gains are taxed at rates far lower than the income the average worker earns through actual work. Money making money is rewarded, while labor is increasingly devalued.

This isn't some natural evolution - it's the result of deliberate policy choices that have concentrated wealth upward just as effectively as anywhere else. The safety net that the workers movement fought to create has gradually eroded, leaving even middle-class Swedes facing the same uphill battle as everyone else.

This isn't some natural economic law at work. It's the predictable outcome of policy choices designed to reverse the mid-century wealth distribution and concentrate wealth at the top.

My father lived through this reversal. He started his career during a period when wealth flowed more evenly, only to spend his final decades watching that balance deteriorate as the system increasingly favored wealth extraction over wealth creation.

By the time he died in 2022, the forces grinding down the middle class had been running unchecked for over 40 years.

The key insight here is both disturbing and hopeful: this is not inevitable.

The economic forces driving this are not mysteries. They're the result of conscious decisions and specific policy choices that can be reversed.

We know how to fix this, because we’ve done it before. The solution isn’t some untested theory or radical experiment. It’s a set of policies that once created the most prosperous and stable middle class in history.

The real question isn’t whether we can solve wealth inequality. It’s whether we have the collective will to demand the changes necessary to do it.

What This Means For You

Once you see this wealth transfer pattern, it becomes impossible to ignore.

That persistent feeling that you're working harder but falling behind? It's not your imagination. The gap between productivity and wages isn't some abstract economic concept - it's the difference between what you generate and the fraction of it you’re allowed to keep.

The way prices always seem to rise just a little faster than your income? That’s not a coincidence or random inflation; it’s a direct reflection of how wealth is extracted, moving upward while the purchasing power of wages shrinks.

The fact that previous generations could afford a house on one income, but you struggle with two? That's not because you're worse with money - it's because asset prices have been deliberately driven beyond what labor can purchase.

Once you understand this, so many of the frustrations you experience daily start to make sense:

Why you feel trapped in a job you hate but can't afford to leave

Why homeownership seems increasingly out of reach despite your best efforts to save

Why starting a family feels like an economic gamble rather than a natural milestone.

Why your hometown is either in decline or increasingly unaffordable.

Why anxiety about money persists even when you're "doing everything right"

Recognizing the pattern doesn't immediately solve these problems, but it does change the narrative and provide something invaluable: the correct diagnosis.

It replaces self-blame with a structural understanding of what’s actually happening. The financial struggles you're experiencing aren't (just) because you're lazy, untalented, or making bad choices - they're the predictable outcome of a wealth extraction system working exactly as designed: To extract value from the many and consolidate it among the few.

What’s Next?

This understanding liberates you from the suffocating myth that your economic situation is entirely your responsibility to fix. It explains why traditional advice - work harder, get more education, save more - increasingly fails to deliver financial security.

But what does this mean for your future and your family's future?

If the wealth transfer mechanism continues accelerating, each generation will face a harsher reality than the last. Your children will likely work even harder for even less security than you have. Geographic mobility will become a necessity rather than a choice, forcing families to separate as younger generations chase opportunity. The gap between those who own assets and those who don't will widen into a chasm that becomes nearly impossible to cross.

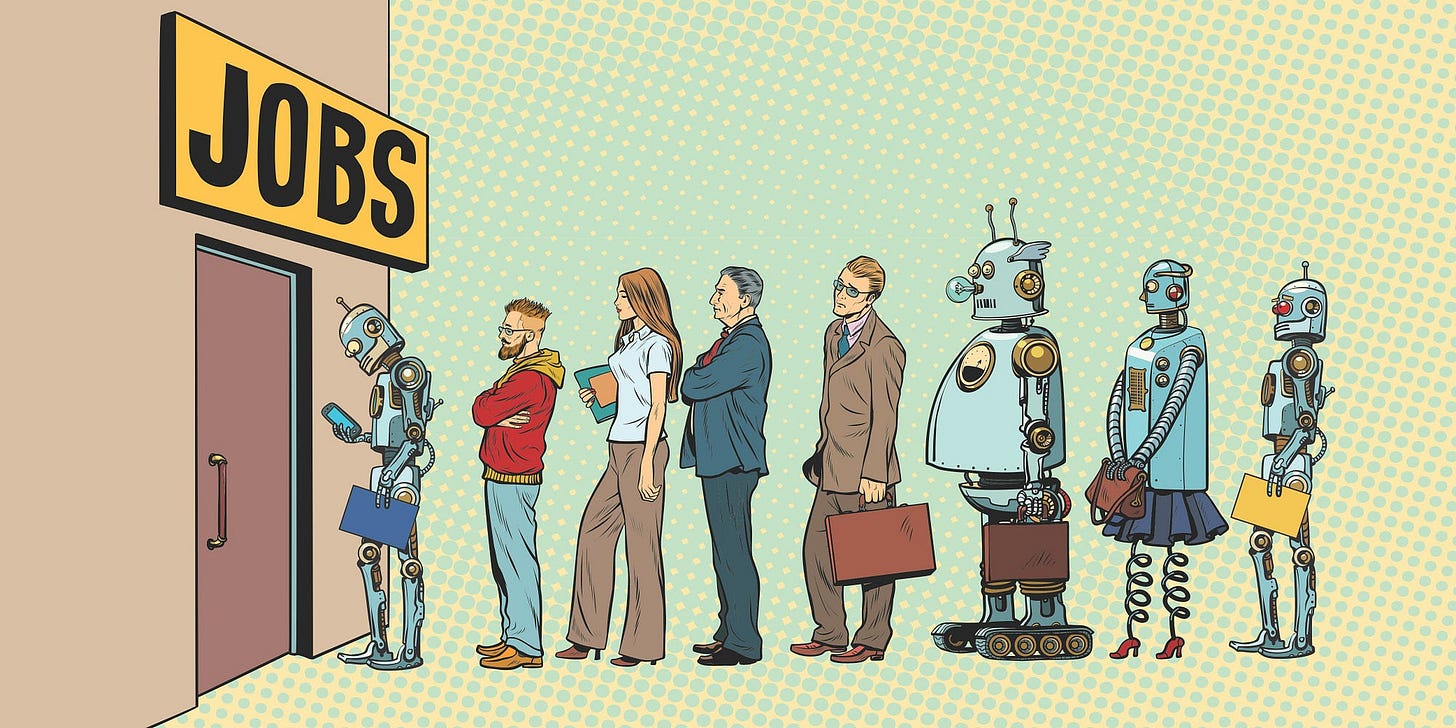

And then there’s AI.

AI isn’t merely another technological shift - it’s a wealth concentration accelerant. As intelligent systems replace human labor in fields once thought immune to automation, the profits will flow to the handful of billionaire oligarchs who own these systems, not to the workers being displaced, and further tightening their grip on capital and decision-making.

This won't just continue the current pattern of wealth extraction - it will make it exponential, creating wealth gaps more astronomical than anything we've seen before.

This isn't fatalism - it's the mathematical projection of current trends. Left unchecked, the wealth extraction machine will continue to concentrate assets upward while draining security from everyone else.

The Choice Ahead

You face a choice in how to respond to this reality.

One option is to focus solely on your personal situation, trying to navigate the system as best you can - acquiring assets, building financial leverage, positioning yourself on the right side of the divide. Some succeed in this - at least today - though the window of opportunity, if there really is one, is closing quickly.

Or you can combine personal navigation with awareness of the larger pattern, recognizing that your personal struggles connect to millions of others experiencing the same systemic extraction. And to understand that change only becomes possible when enough people stop accepting the status quo as inevitable. This awareness is the first step toward collective action that could actually change the underlying structure.

Call to Action

This isn’t just my father’s story, it’s everyone’s story - but in its specifics, it reveals something universal. The same forces that drained his life of time, energy and opportunity are at work in yours. The same slow grind, the same silent theft, the same unfulfilled potential.

When a man works from the age of 15 to 64 and drops dead before he can finally build what he truly wants, we've lost more than just one life. We've lost the innovations he never got to create, the wisdom he never got to share, the impact he never got to make. Multiply that loss by millions, or billions, and you begin to understand the true cost of this wealth extraction machine.

This isn't just about money. It's about human potential systematically diverted from its natural expression and channeled into fortifying the fortunes of those who already have more than they could ever need. It's about generations of creativity, innovation, and care sacrificed on the altar of asset accumulation. It’s about an entire economic structure that keeps people working just hard enough to survive, but never free enough to truly thrive.

Recognizing and naming this pattern is the first step toward changing it. But awareness alone isn't enough. We need to start actively organizing against what's coming, stop complying with our own enslavement, demand change, and end the cycle of giving our power away to those who don't give a single fuck about us.

This tiny elite who controls most of the wealth have no power we don't give them.

When enough people withdraw their consent and support, even the mightiest corporate empires can fall. We've already seen glimpses of this potential - moments when coordinated action has wiped billions off the valuations of companies that prioritize profit and power over people.

And we know what works. We've done it before - redirecting wealth flows, restructuring the economy to create decades of widely shared prosperity. That didn’t happen because politicians suddenly became generous. It happened because people organized, demanded better, and refused to accept the status quo.

It can happen again. But not through empty political promises. Not by waiting for those who benefit from the system to change it.

It happens when people take action:

Divest from exploitative corporations run by manipulators.

Support local and worker-owned businesses that distribute wealth rather than hoard it.

Pool resources to acquire collective assets and reclaim economic power.

Strike and protest when necessary.

Demand wealth taxes and financial transaction taxes from politicians at all levels

Build mutual aid networks to meet community needs beyond the reach of the extraction economy.

Or join the people who are creating alternative systems outside the the current one.

The path forward isn't mysterious. It's clearly marked by historical precedent. The question is whether enough of us will recognize it in time to change its trajectory.

My father never got to build his workshop. But maybe his story, and the larger truth it reveals, can help build something greater - a movement of people who understand what's happening, refuse to accept it, and create something different.

The person who was my anchor, my hero, is gone. But the understanding his life gave me remains. And now, I share some of that with you.

See the pattern. Name it. And know this: you are not alone.

Your financial struggles aren't a personal failing - they're the predictable outcome of a wealth transfer mechanism that's been accelerating for decades.

But systems designed by humans can be redesigned by humans.

The time for change isn’t in some distant future. It’s already begun. Millions are waking up to the same realization. Together, we have the power to redirect the flow of wealth back toward those who create it and with it, create something far better.

The only question left is whether we will act before it’s too late.

Because once you see it, you can’t unsee it.

And once enough people see it - it cannot continue unchallenged.

In loving memory of my father.

Erik

Continue reading:

Checkmate: The Triumph of Technocracy (Part 1)

How Trump, Elon & The Tech-Elite are Paving the Way for a Brave New World and what it means for all of us.

Triumph of Technocracy Part 2: The Ultimate Deception

How the Pandemic Sorted, Profiled, and Set Up the Resistance for the Perfect Trap

"The Matrix" Is Not What You Think - Here’s Why It Matters

How Your Perception of Reality Has Been Engineered - And What You Can Do About It

The Last Red Pill: Becoming Truly Unfuckwithable

The Inner Power No Algorithm Can Hack, No Government or System Can Control, and the One Truth That Frees You From It All

Thank you Erik and your loving father! May this article inspire others to break the mould and aspire to bring down the predator class.

You understood the problem, but you're missing a fundamental point in your article: you're completely ignoring the role of fiat money, and how wealth it's actually extracted from normal people, and spoiler: no, it's not Elon musk's fault.